The Afficiency Digital Platform

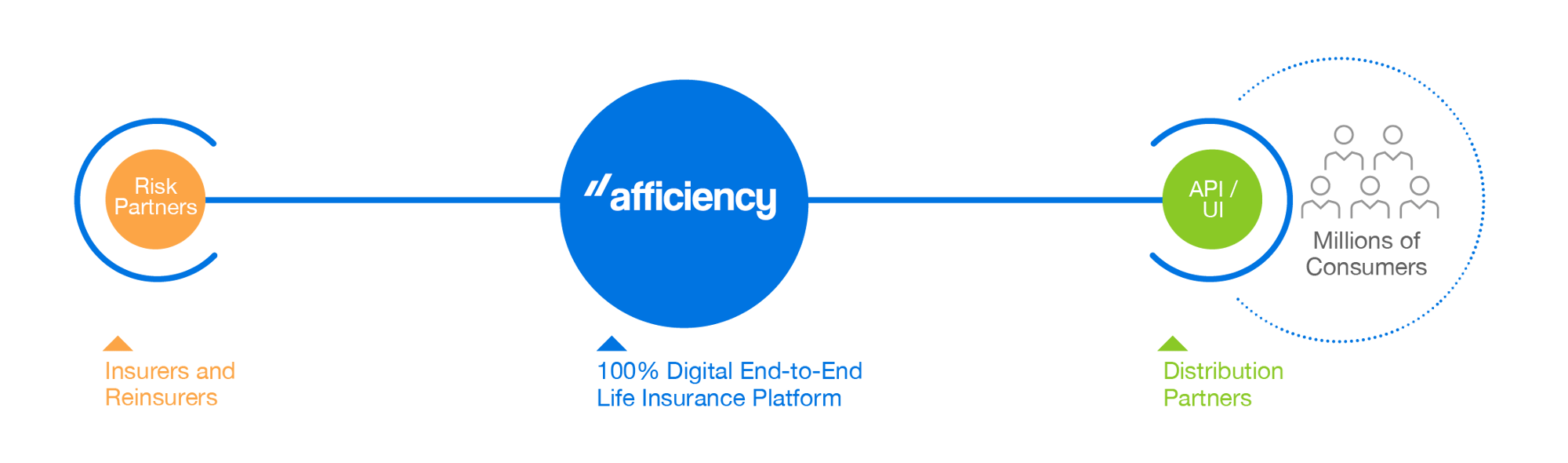

U.S. life carriers and distributors recognize the need for digital transformation. However, our industry is plagued with outdated systems and process, making the road to digital transformation long and difficult. At Afficiency, our goal is to deliver innovative life insurance products 100% digitally, throughout the entire customer journey from quote to policy issue to administration.

As consumers recognize the need for life insurance, we understand they have an expectation that life insurance should be easy-to-understand and easy to purchase. To this new breed of consumers that means being available via a streamlined digital platform. Afficiency is the 100% digital, end-to-end life insurance solution, designed to engage customers and offer innovative products in an producer-led environment.